2 min read

AI in Finance: Addressing the Failure of Current Models (Uncertainty, Risk, and Trust)

Rob Blackie : Feb 10, 2026 4:45:58 AM

Investment teams don’t struggle to find models. They struggle to trust them—especially when market regimes shift (e.g. during a deep recession or time of high inflation). This blog summarizes what we have developed, what we learned from the evidence, and why an uncertainty-aware approach can help teams evaluate portfolio decisions without jumping to automation.

This work uses backtests on customer provided data. The recommendations have been developed as an input to human review by fund and risk management teams.

The problem: why adoption stalls

AI adoption in portfolio decisions usually breaks for practical reasons:

- Risk constraints are real. A strategy that looks good without guardrails can fail once you apply volatility, drawdown, and turnover constraints.

- Trust requires repeatability. Teams need to rerun the same experiment, compare against the same baselines, and see stable behavior across stress windows.

- Markets change behavior. Correlations shift and uncertainty increases, and models that assume “normal conditions” can become brittle.

- Explainability. Multi-billion-dollar investment decisions cannot be made using a black-box system without understanding why it makes those recommendations.

The challenge: uncertainty and unexpected events

Markets don’t just move—they change how they move. During calm periods, many approaches look stable. During times of market stress, relationships can shift quickly, and that’s where decision support is really tested.

A second challenge is signal quality. It’s easy to add indicators that help explain history. It’s harder to find signals that consistently help decisions going forward—especially once you apply constraints. In our work, some added indicators improved fit to historical data but did not consistently improve portfolio outcomes—an important negative result that helps narrow what’s worth testing next.

How GeniusTM works

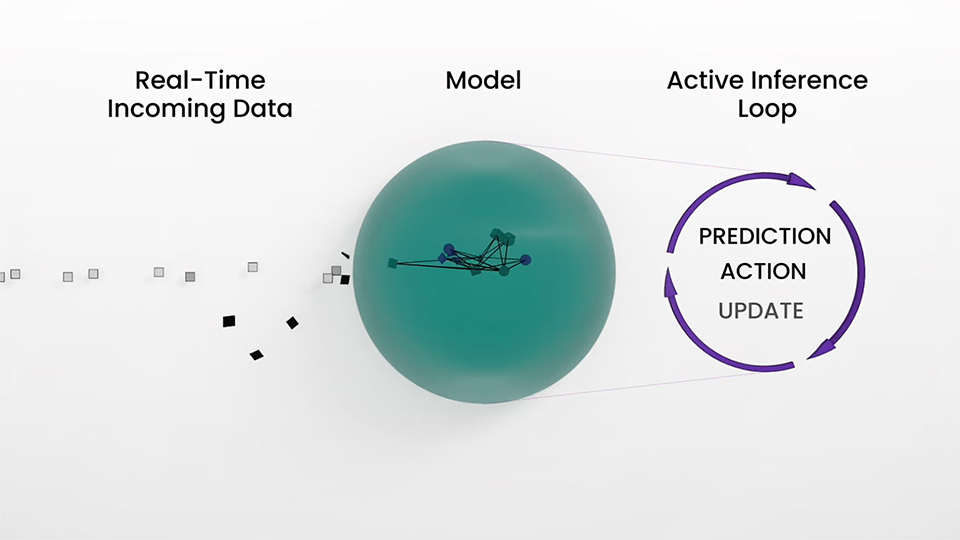

The goal of VERSES Genius isn’t perfect prediction. It’s to estimate a range of plausible outcomes, update those estimates as data changes, and propose human-reviewable portfolio weights that can be evaluated under guardrails.

While the exact path of asset prices can’t be fully predicted, just knowing when the market is becoming riskier, or less risky, opens up opportunities. For instance, our model can quantify a risk as “equities are 80% likely to increase in price in the next month, and in the 20% scenario they are 90% likely to fall by less than 5%” and provide evidentiary support for these predictions based on market and macro indicators. By doing so, asset managers can make better judgments about the trade-offs between risk and return.

Explicit quantification of risk is particularly valuable when it allows managers the confidence to quickly respond to major market changes, such as the “Global Covid Pandemic“ and “Russia-Ukraine War” crisis that triggered market shifts in 2020 and 2022.

In situations like these, the initial warning signs will be low-probability events occurring more frequently than expected. This will then trigger our models to examine which, previously unlikely, hypotheses are now looking more probable, for instance, a relationship between two variables has reversed. It first alerts managers that risk has increased, then recalibrates as new data arrives, allowing predictions to become more confident over time.

Uncertainty quantification for asset classes

Our models constantly update their estimates of uncertainty for three classes of assets over time, and the relative likelihood of each outcome. Asset 2 is a short term government debt class, so it exhibits low uncertainty, while asset 0 is a equity instrument exhibiting higher uncertainty, which can be seen especially in March to May 2020 as the COVID pandemic took hold.

What this means for investment teams

The near-term value is not automation. It’s a disciplined way to evaluate decisions under uncertainty—using repeatable runs, clear baselines, and explicit guardrails. Instead of debating models in the abstract, teams can review evidence artifacts and agree on what holds up across stress windows.

In our work with a large global asset manager, we have demonstrated that Genius can help them achieve higher returns while managing risk in compliance with their governance policies.

VERSES model performance against alternative investment approaches

Illustrative investment performance against alternative approaches starting from 2019 baseline, with only monthly rebalancing, when constrained by target volatility, drawdown, and Sharpe ratios.

Book a Demo

A short demo is the fastest way to walk through these models —based on evidence, not enthusiasm.

Disclosure: This page is for informational purposes only.